FXTB CFD Review

Average Review

Register your FXTB account through Coin Insider and receive a FREE Personal Account Manager to walk you through your account setup process.

The foreign exchange market – also known as forex or the FX market – is the world’s most traded market, with turnover of $5.1 trillion per day.

To put this into perspective, the U.S. stock market trades around $257 billion a day; quite a large sum, but only a fraction of what forex trades.

Forex is traded 24 hours a day, 5 days a week across by banks, institutions and individual traders worldwide. Unlike other financial markets, there is no centralized marketplace for forex, currencies trade over the counter in whatever market is open at that time.

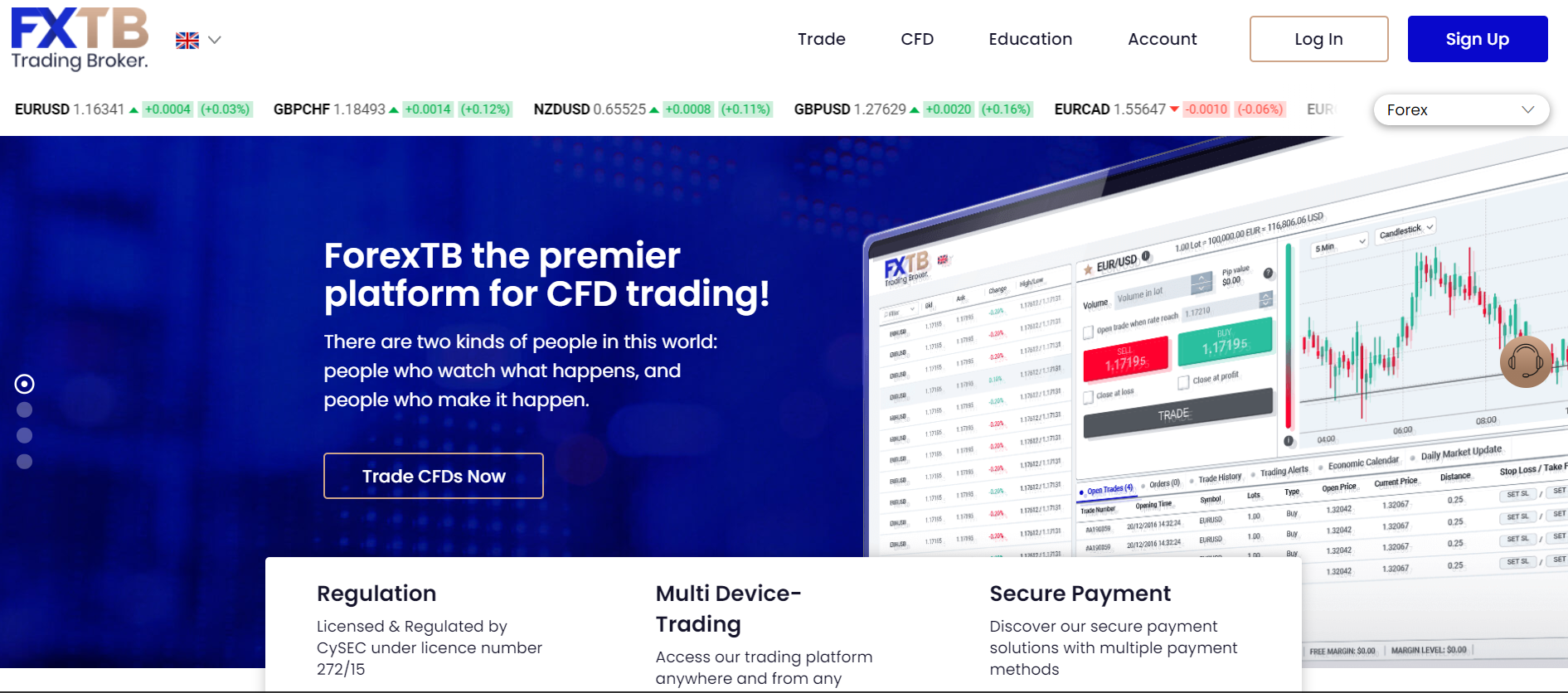

Today we will be reviewing a CFD platform called ForexTB.

FXTB is a CFD broker. The trading app is well liked by new day traders and investors due to its simple interface and intuitive design. Experienced Forex traders will be able to download the industry standard MT4 trading platform.

FXTB offers over 300 underlying assets for trading, and they margin rates are limited to 30:1 as per the European Union laws.

As a European broker, FXTB’s website is localized and developed in multiple languages including English, German, Spanish, Italian, Swedish, and Nederlands. You can have your trading account denominated in these currencies; USD, EUR & GBP.

Demo trading accounts are available at ForexTB, and the minimum deposit for a Basic level trading account is $250.

Behind the ForexTB brand is a Cypriot investment company; it has a license from the Cyprus Securities and Exchange Commission.

ForexTB provides its users with the tools needed to reach their potential. Their education center on the website provides thorough materials on Forex, commodities and more. They offer trading analysis, leverage and margin, and market news along with Trading Center market alerts and advanced study.

Register your FXTB account through Coin Insider and receive a FREE Personal Account Manager to walk you through your account setup process.

The FXTB account levels vary according to the deposit made; the minimum deposit is 250 euros; there are no fixed commissions.

We have examined the features of the different accounts and summarized the main advantages of each level below.

Basic: With a minimum deposit of 250 euros you have one trading lesson, Daily News, Trading Signals, 2 SMS notifications per day, one free withdrawal and an average spread for EUR / USD of 2,8 pips

Gold: With a minimum deposit of 25,000 euros, you have two trading lessons, Daily news, one monthly Webinar, Trading Central, 2 SMS notifications per day, one free withdrawal per month and an average spread per EUR / USD of 2.5 pips

Platinum: With an opening deposit of 100,000 euros, you have access to 3 advanced lessons, Daily news, two monthly Webinars, the Trading Central, four notifications via SMS per day, three free withdrawals per month and an average spread for EUR / USD 1.9 pips

VIP: With a deposit of over 250,000 euros, you can access to 5 advanced lessons, Daily news, five monthly Webinars, the Trading Central, seven notifications via SMS per day, unlimited free withdrawals and an average spread for EUR / USD of 1.4 pips

ForexTB allows clients to open trading positions with as little as 0.01 lots. There is no limit to the trade size, and traders can take on leverages of up to 1:30. ForexTB offers a chart filter, which enables the trader to see the populated traded assets. After this process it is easy for traders to calculate the spreads on each asset.

When opening an account with ForexTB you will be able to choose between the platform’s own trading interface or the award-winning and bespoke Meta Trader 4 (MT4). The integration of MT4 is particularly useful to traders who have used this tool and don’t wish to change. In reality, however, both trading platforms offer investors an opportunity to access the same range of assets, tools, and features.

Besides the live trading platforms, ForexTB offers a free demo account to all users. This account comes complete with 100,000 of your select currency, allowing you to test out various investment strategies risk-free. In most aspects, the demo account functions exactly like the real ForexTB trading platform, giving you an excellent opportunity to learn how to use the platform efficiently.

Depending on which trading platform or more you choose, you will have access to all major markets. Use ForexTB to carry out cryptocurrency CFD trading or opt to invest in Forex, commodities, stocks, indices, or ETFs.

Whilst the platform has a wallet where you can store your fiat currency, it does not provide a cryptocurrency wallet. The trading platform lets you invest in Bitcoin CFDs and several other cryptocurrencies, but does not support any crypto-based transactions. Therefore, you won’t be able to send or receive any cryptocurrency to your ForexTB wallet.

The ForexTB platform has been designed to be user-friendly and intuitive. With a good balance of white space and crisp graphics, it is easy to navigate through the site and read the information provided. Apart from English, the website is available in six other languages, including German, Polish, and Dutch.

Throughout the website, you will find useful links and guides. If you are completely new to trading or wish to learn about specific elements, you are likely to find answers in the Help Centre accessible from the top navigation menu.

Opening an account is simple and straightforward. Apart from requiring your personal information, the signup procedure includes a few trading questions which you need to answer correctly. These questions help ensure that you are only allowed to start trading if you have a basic understanding of CFD investments, and are there to protect you. These questions also fulfil one of the requirements for the platform’s operating licence.

Opening an account with ForexTB is fast and easy. All you need to do is:

Upon completion of your ForexTB sign up, you will receive an email confirmation. Click on the link within the email to verify your email address.

In order to stay operational and safe, ForexTB needs to charge fees. The platform implements a transparent and simple fee structure which is easy to understand and calculate. Depending on the type of trading account which you have opened you could get special discounts and other benefits. Whilst this ForexTB review is focusing on retail investor accounts, the platform offers a professional investor account with different fee structures and benefits.

The main fee charged by the platform is the spread. Since ForexTB does not charge commissions, it generates revenue by adding a small markup on the buy and sell price of an asset. The spread is calculated in pips and is already added to the price of the asset whenever you open or close a position. As a basic account user, the spread for the EUR/USD pair is 2.5 pips, whereas for a VIP account the fee decreases to 1.1 pips.

Every market has an end of day time which is considered to mark the transition from one day to another. Any positions open at this time are charged a swap fee which varies depending on the asset.

ForexTB does not charge any deposit fees. Withdrawal fees, on the other hand, vary depending on your account. VIP accounts enjoy free and unlimited withdrawals. Basic account users can make just one free withdrawal and are charged a fee depending on the payment method.

If you have no account activity, including deposits or withdrawals, for a period of one month or more, an inactivity fee will be charged. This fee can be as high as €80, and you can prevent it by performing at least one transaction a month. Accounts which have been inactive for extended periods of time can be closed permanently.

The main limits of ForexTB relate to deposits and withdrawals. When funding your account, the platform requires a minimum deposit of €250. Whilst there is no minimum withdrawal limit for payments made to cards or eWallets, withdrawals via bank transfer have a minimum requirement of €100. There is no maximum limit on the amount value of withdrawals.

A common mistake among new traders is failing to look at the legal document, especially on matters related to fees.

From what we gathered, the total amount of fees charged by ForexTB is likely to end up exceeding the amount of deposit you make. And this is one of the characteristics of scam brokers.

ForexTB only gives one free withdrawal to Basic account holders. From then on, a withdrawal fee is charged. Gold accounts get one free withdrawal per month, while Platinum accounts get three withdrawals per month.

Here are three things that are meant to discourage traders from withdrawing their money:

Limited free withdrawals

5% fee for credit and debit card withdrawals

30 USD/EUR/GDP fee for wire transfers

There is another hurdle that is bound to discourage withdrawals. ForexTB can charge a client €80 for failing to provide adequate identification documentation by the time they make a withdrawal request. The loophole in this is that a trader cannot control what the broker deems as ‘adequate identification.’

In addition, ForexTB charges a high dormancy fee of €80 for accounts with inactivity of one month or more. Note that placing one position does not count as ‘activity.’

The €80 is charged every month until there is significant activity in the account.

There are swap fees that are charged when a position is held overnight. The exact amount depends on market conditions.

The legal document further states that the swap fee is charged three times on Wednesday to cover for weekends.

These unrealistically high fees are enough reason to draw a conclusion on this ForexTB review. But wait, there is more.

ForexTB offers the ability to deposit funds fee-free via credit/debit card, electronic payment and wire transfer. This can be done directly from the client portal area and trading platform once logged in.

Withdrawals are charged at 3.5% for credit/debit cards and 30 USD/EUR/GBP for wire transfers. This can also be done in the Banking section of the client portal area once logged into the trading platform.

Trading is commission-free with ForexTB but spread and swap costs vary depending on the instrument being traded and account type opened.

“In accordance with regulatory restrictions, ForexTB does not offer any bonuses or promotions.’’

ForexTB offers customer support via email, telephone and live chat but only during regular offices on the weekday. They also provide access to a detailed FAQ section. After calling the broker’s telephone number we were greeted with options to choose from different languages and connected in good time.

Contact Information:

Address: Lemesou Avenue 71, 2nd Floor 2121 Aglantzia, Nicosia, Cyprus

Phone: +357 2 222 2353

Social Media:

https://www.facebook.com/forextb/

https://mobile.twitter.com/forex_tb

In line with its operating licence and security measures, ForexTB requires that all users verify their accounts. The platform implements what has become industry-standard Know Your Customer (KYC) protocols. You can choose to upload the documents from your computer or opt for the more convenient mobile upload.

The two main verification requirements are:

In order to prove your identity, you will be required to provide a photo of your ID card or passport. Proof of residency can be carried out using a recent utility or home bill. Furthermore, if you will be funding your account with a debit or credit card, proof of card ownership will also be required.

When providing documents for verification you need to ensure that:

All four corners of the document are clearly visible in the photo

There needs to be a clear contrast between the document and its background

Document proportions must be maintained

All the details of the document must be legible and no part of the document must be obstructed.

ForexTB has partnered up with several top payment providers to give users a comprehensive choice to make deposits and withdrawals. The main options are:

The automated deposit form will automatically block or activate supported payment methods based on the value of your deposit.

From our observations, ForexTB provides a simple trading offering to trade on more than 300+ markets from two simple to use trading platforms. The MetaTrader 4 trading platform allows advanced traders to use the MetaTrader marketplace and automated trading strategies. The broker’s own web-based platform is simple to use and trade from.

Users can trade on CFDs covering Forex, Stocks, Indices, Commodities and Crypto while accessing research from Trading Central. While trading is commission-free the best spreads are found on the higher minimum deposit accounts. Users should also be aware of the 80 EUR inactivity charge if no activity has taken place within a month.

FXTB offers a demo account that allows traders to explore new strategies and try the two trading platforms available. With $100,000 of simulated money automatically available, there is no risk to your capital.

There are several reasons to consider registering for an FXTB investing account:

ForexTB could improve in the following areas:

The Cyprus Securities & Exchange Commission (CySEC) regulates ForexTB for operation in the European Economic Area (excluding Belgium) and Switzerland. This coupled with positive customer reviews makes them safe to open an account with.

The minimum deposit is $250 for a Basic account; however, this rises to $25,000 for Gold accounts, $100,000 for Platinum accounts, and $250,000 for VIP accounts. The minimum trade size is 0.01 lots.

ForexTB clients can trade using either the highly regarded MetaTrader 4, or the broker’s proprietary Web Trader platform. The FXTB web-based platform is best suited to beginners while more advanced traders will likely want the customisation and sophisticated features that come with MT4.

Yes, a demo account can be opened with ForexTB. With $100,000 of notional money and a simulated market, the fully operational demo account can be useful for exploring strategies, platforms and indicators.

No, ForexTB is currently only licensed to offer trading services in Switzerland and the EEA, though not Belgium.

ForexTB provides investors with a good opportunity to invest in CFDs. Although it is not the largest platform around, its CySEC licence and range of tools give it the necessary credibility to be recommended and tested. The platform is especially useful for newer investors, providing detailed and comprehensive educational support and a free demo account. It is safe to use and offers competitive pricing, especially when you open a higher level account.

[ls_content_block id=”109329″]

| Term | Definition |

| Contract for Difference (CFD) | A Contract for Difference is a well-known type of financial derivative instrument, much like indices, commodities, currencies,etc. |

| Contracts for Difference (CFDs) | A formal agreement between two parties/people to pay the difference in price from when the contract was opened until the contract is closed. |

| CFD Trading | Investors have the option to go short (sell a CFD) if they think a price will decrease or go long (buy a CFD) if they think the price will go up. |

| Margin | The margin refers to the minimum deposit required. |

| Initial Margin | The initial amount required in order to open the position. It is often also referred to as an initial deposit. |

| Average True Range | ATR refers to the measure of market volatility over a specific period of time. |

| Back Testing | Back testing occurs when a strategy is put to the test, by using historical data for validation. |

| Base Currency | The first listed currency in a pair. |

| Commodity CFD | A type of CFD that derives its value for an underlying commodity it’s meant to track. |

| Consolidation Market | A market that is stagnant, neither moving up or down. |

| Currency Pair | Forex is trading in currency pairs. It refers to the price quoted in terms of the relative values of one currency against another. |

| Leverage trading | Also referred to as margin trading. The process in which an investor borrows a large amount of money from a broker to open a larger position. |

| Leverage ratio | The amount of leverage/money provided by a broker to trade a leveraged product. The amounts typically offered are 5:1, 10:1 and 30:1. |

| Maintenance margin | The amount of minimum funds needed to keep positions on the account open. |

| Used Margin | The amount of money that is currently used to keep positions open. |

| Equity | The total value in an investors account. |

| Free Margin | Funds available on an account to trade with (not currently being used by open positions). |

| Overnight charges | A Fee charged by a broker for holding a position over night. It is also referred to as an overnight financial charge and is linked to the interest rate of the currency being traded. |

| Buy position (“going long”) | A long position is the purchasing of an asset, with the expectation that its value will increase. |

| Sell position (“going short”) | A short position refers to the sale of an asset. with the expectation that its market value is set to fall. |

| Slippage | The difference between a requested market price and the actual price the trade was filled at. |

| Debt-To-Equity Ratio | The ratio of the total debt of a company to the amount of capital that shareholders have invested in the company. |

| Derivatives | A financial instrument that obtains its price from underlying security, index, currency pair or commodity. |

| Donchian Channel | An indicator that has two boundary lines determined by the highest and lowest points. |

| Downtrend | A series of lower highs and lower lows in the cryptocurrency market. |

| Earnings Per Share (EPS) | The profit the company makes is divided by the number of outstanding shares the company has. |

| Ex-Dividend Date | The very first day, a buyer of a share no longer obligated to a payment of the dividend the stock (or CFD) offers. |

| Exposure | The sum total value of all your positions in the market at any particular time. |

| Finance Charge | The price charged to hold a given position from one trading day to the next. This charge is generally calculated, based on the country’s cash rate plus a small interest charge. |

| Fixed-Dollar Model | A certain fixed-dollar model, where a certain amount is allocated to risk on any given day. |

| Fixed Percent Risk Per Trade | This refers to a risk management model where a certain amount of money is allocated to overall trading capital. |

| Forward Testing | Testing a strategy in real time, while the movements in price unfolds. |

| Fundamental Analysis | A method developed to evaluate the value of a company relies on financial statements, PE ratios, future growth projections and company financial statements. |

| Post-market Auction | The last available trading opportunity for the day before the market closes. |

| Pre-Market Auction | The identical matching out of prices |

| Price-to-Earnings Ratio (PE) | Determining the projected worth of a project by dividing the current market price by the earnings per share. |

| Product Disclosure Statement (PDS) | A document held by every financial services company, to provide to their clients regarding their products or services. This document will outline how the product in question worked, its potential benefits, and associated risks. |

| Pyramiding | A rule where traders add to their existing position(s) in an attempt to maximize the potential profits on winning trades. |

| Range-Bound Trading | Trading in a range where the value fluctuates between two main points. The two points are typically referred to as “Support” and “Resistance.” |

| Return On Equity (ROE) | The return a company generates based on the net assets they hold. |

| Return On Investment (ROI) | The amount of return you’ve realized on your deposited capital. |

| Scaling In | Initiating a trade by opening a small position in order to determine your readiness to bring it up to a normal position. |

| Scaling Out | Gradually closing your trade as it moves in your favor or reaches some specified profit objective. |

| Technical Analysis | Any mathematical formulas used over the price and/or volume history of the market in an effort to determine the probable next move of any particular asset. |

| Volatile Breakout Trading | A type of trading strategy that attempts to take advantage of short, sharp movements in the market over relatively short periods of time. |

| Volume | A measure of the number of shares or contracts that are solidified over a set period of time. |

| Trend-Following Trading | A trading strategy that attempts to profit from markets that tend to move either up or down for extended periods of time. |

| Trend Line | A line drawn across a chart to line up successively higher bottoms in up-trending markets |

Explore More Reviews: